Lawmakers considered a bill Monday that would extend the state’s sales tax break on electric vehicles — but only for cars that cost up to $35,000. Several people testified in support the tax break, but had concerns about proposed price cap.

Under House Bill 2087, car buyers would not have pay thousands of dollars in sales tax on an electric vehicle that can travel at least 30 miles on battery alone and is under the proposed $35,000 price cap.

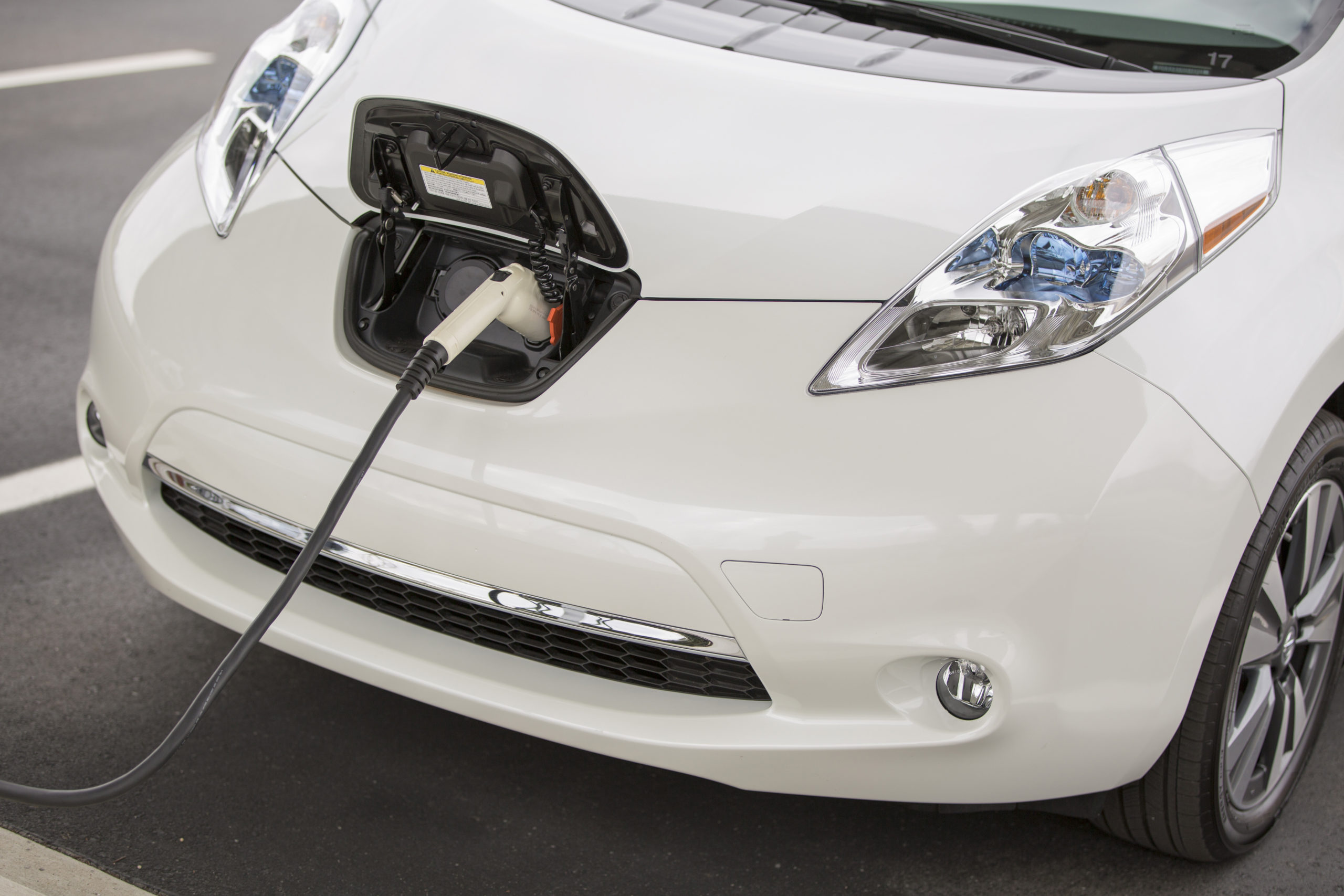

That would apply to cars such as the Nissan Leaf, the Chevrolet Spark and the electric Ford Focus.

J.J. McCoy of the Seattle Electric Vehicle Association says the current tax incentives are a big reason why many recent purchasers have gone electric.

“A recent study shows about 63 percent of the market share in Washington state is due to the sales tax exemption,” he said. Half the market could disappear if the sales tax exemption were left to expire, he said.

Although he supports the bill, he has concerns about the $35,000 price cap excluding more expensive electric cars, one of which has a major part made in the state.

“The BMW i3 which uses the carbon fiber made here in Moses Lake would not apply,” he said.

Mike Ennis of the Association of Washington Business also echoed those concerns about the price cap.

“We believe that you would be hurting the manufacturers who are leading in EV innovations. Manufacturers like GM, Tesla and BMW provide models that would fall on the other side of the cap,” he said.

Speaking on behalf of the bill, Rep. Ed Orcutt, R-Kalama, says the bill writers intentionally targeted the lower-priced cars.

“The tax break doesn’t determine whether they will buy a Tesla or not. But it does make a difference for someone who would buy an ordinary sedan to get them from a gas-powered to an electric vehicle. We think this is the magic price point,” he said, adding that the bill writers would be willing to consider a price a few thousand higher.

The bill also sets annual registration fees for electric vehicles at $150 dollars a year, some of which would help build more charging stations throughout the state.

Orcutt says that will help build the industry.

“Until there are more electric vehicles out there you’re not going to have enough charging stations. Until you get more charging stations out there, people are going to be reluctant to buy the EVs,” he said.

Orcutt said it also would not be a bad thing if the dealerships felt compelled to drop prices on certain models in order to qualify for the tax break.

“We’re trying to make these more affordable to the general public, to the middle class. If it creates a downward price pressure, to me that’s a good thing,” he said.

The committee took no action on Monday. The current sales tax break on electric vehicles is set to end in July.